Online shoppers can manage their finances more accurately and securely by accessing their credit cards. With the online account portal, customers can make instant payments, view their bank statements, monitor their account activity, and update their account profiles at any time by logging into a smartphone or internet-connected computer. Even if your range is moderately cheap, why not get more discounts? You can easily earn all your money by buying a Mauritius bank card.

How To Apply For Maurices Card?

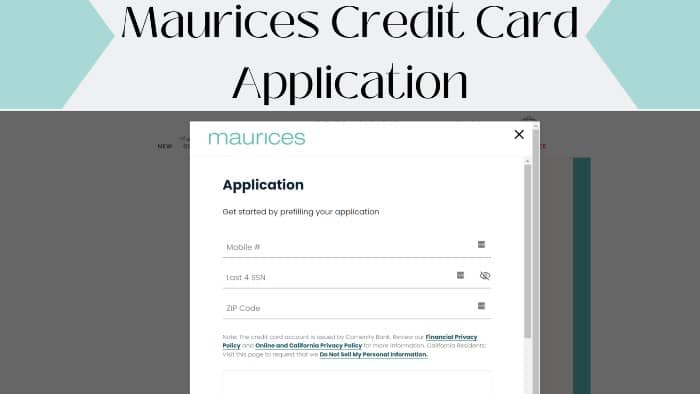

- Visit https://www.maurices.com/creditcard/

- Browse and click APPLY NOW

- Read Maurices’ Terms of Reference and click Apply Now.

- Please include your cell phone number, the last four digits of your social security number, and your zip code.

- Scroll down and click Next

- Provide your personal information, contact details, and financial information

- Click Apply Now

- It should be noted that an application and approval must be completed on the same day for the credit card offer to be received.

Maurices Credit Card Fees

- APR for purchases: 28.49% Please note that this APR varies by market depending on the base rate

- Minimum Interest Rates – Interest rates are no less than $2.00 per credit plan

- Annual fee – There is no annual fee

- Late Payment Fee: Approximately $38.00

- Return costs: up to $37.00

Benefits Of Application

- Make your payment online with a Mauritius bank card

- Manage payments and account settings

- Update your registered personal information

- Opt for electronic invoicing

- Add an authorized buyer

- Request credit limit increase

- Check current account balance

- See available loan amount

- View current and past transactions

- View current and past bank statements

- View scheduled and one-time payments

- Send them a question via the secure message center